At ABC Ignite, we believe that intelligent billing practices are the key to transforming past-due accounts into paid ones, ultimately boosting collections and improving your club’s overall financial health. Let’s explore how advanced billing and payment management strategies can help you achieve this goal.

The power of intelligent billing

Imagine running a fitness club where cash flow grows, collection rates are high, and administrative tasks are minimal. This doesn’t have to be a dream—it’s achievable with intelligent billing.

The impact of smarter revenue cycle management

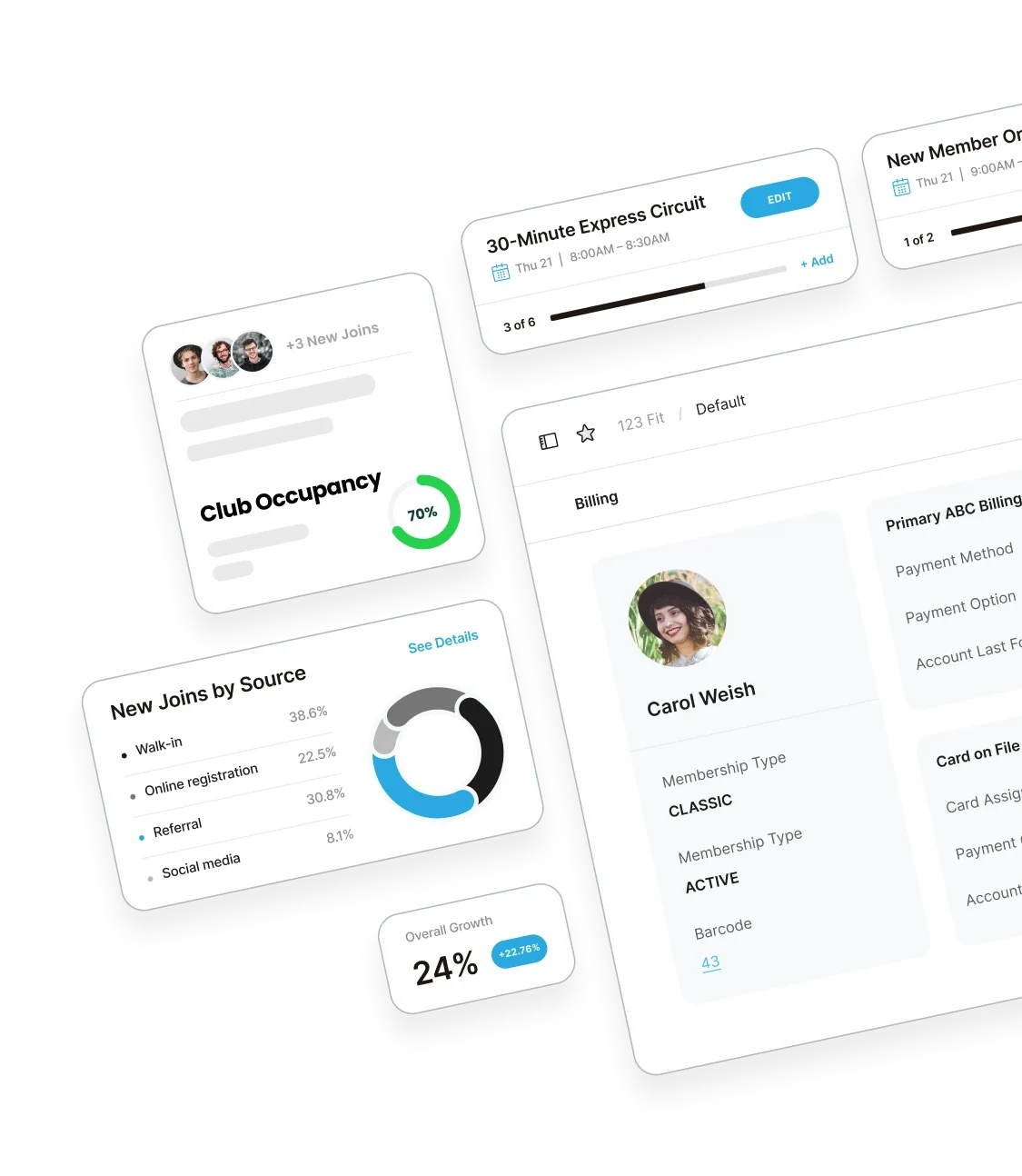

By making various improvements to your monthly collection rate, you can see a dramatic impact on your bottom line. In fact, increasing your collection rate by just 1-3% monthly can significantly enhance your financial stability.

Here’s what smarter revenue cycle management can do for you:

- Increase Total Revenue by up to 35%: Better cash flow management ensures your club can cover its expenses, invest in new equipment, and enhance member experience.

- Increase Collection Rates to 95%: High collection rates mean more predictable revenue and less time spent chasing payments.

- Decrease Past-Due Accounts to 5%: Reducing the number of past-due accounts frees up resources and reduces stress for your staff.

- Reduce Administrative Time to 0%: Automation and efficient processes mean your team can focus on what they do best — serving your members.

To visualize the journey to payment predictability, check out the infographic below, which highlights the key steps and strategies we recommend for optimizing revenue collection.

Why intelligent billing is critical in 2024

Trend #1: Macro-economic pressures

This year, inflation and rising costs are squeezing both consumers and businesses. Mortgage rates, student loans, and everyday expenses are at an all-time high, while consumer debt is soaring. Data shows that 1 in 6 Gen Zers has maxed out at least one credit card. These macroeconomic trends heavily impact the fitness industry, making revenue collection more critical than ever.

Trend #2: Improvement opportunities for club performance

Year over year, the average club is seeing a 10% drop in revenue compared to 2023. This decline pressures clubs to attract new members while maximizing existing collections. The competitive landscape demands more efficient and effective revenue management strategies.

Maximize Your Gym’s Revenue Collection: A Smarter Billing Checklist

Discover moreTrend #3: Changing payment preferences

Collecting payments from new members is becoming increasingly challenging. According to ABC Ignite’s proprietary data found in our January 2024 Innovation Report: Active Consumer Study Insights & Findings, just over 50% of new joins are under the age of 35 (Millennials and Gen Z). This means traditional banking methods are replaced by digital wallets and other innovative payment options. Around 50% of new payment methods fall outside conventional banking and decline four times more frequently than traditional payment methods, adding complexity to the collection process.

Embracing innovations in payment optimization

Keeping up with the latest strategies in payment optimization is essential for maintaining a competitive edge.

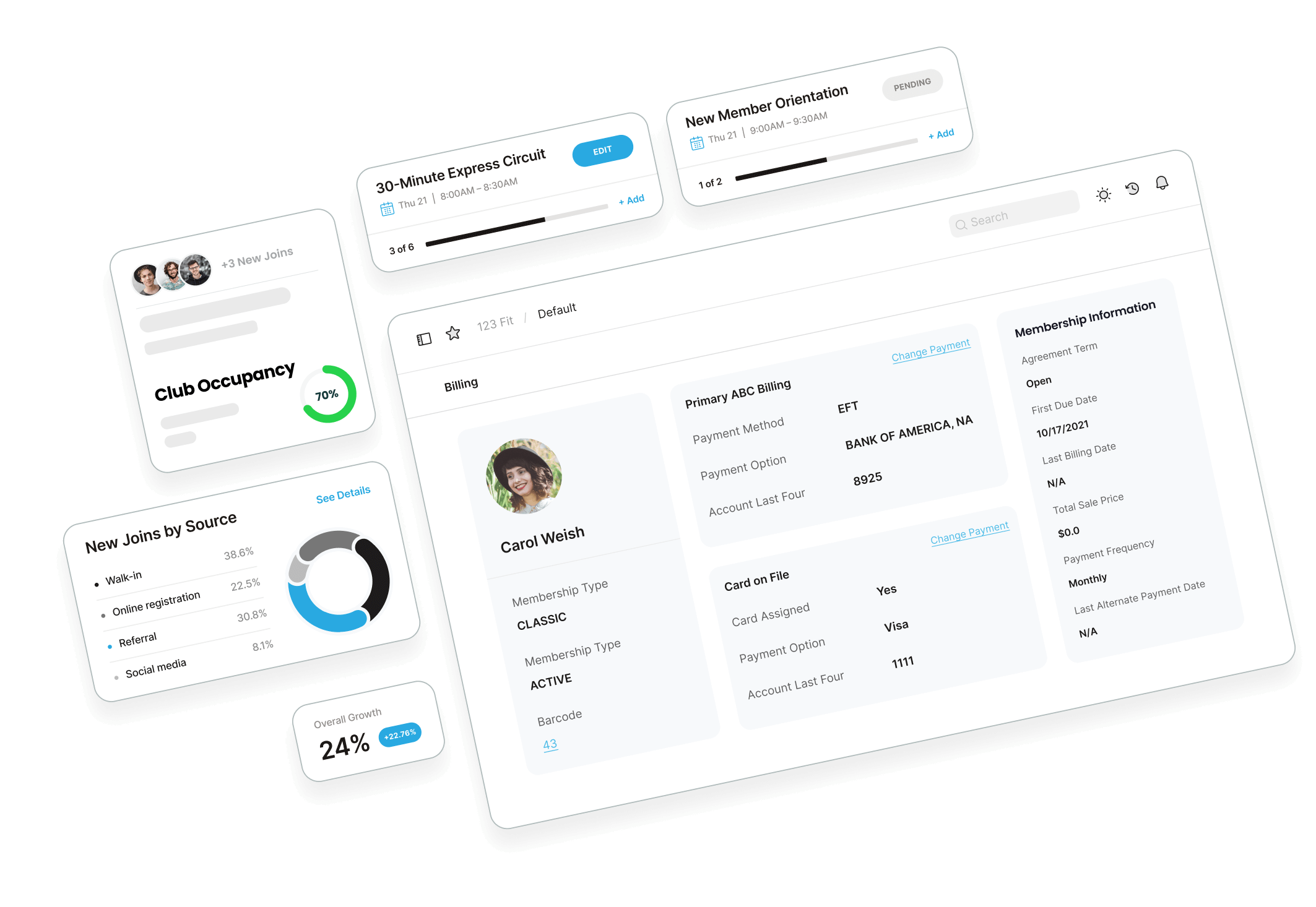

The power of flexible payment options

The advancement of flexible payment options in the fitness industry presents a significant opportunity to enhance success rates and overall revenue. By offering multiple payment methods, including credit/debit cards, ACH transfers, and digital wallets like Apple Pay and Google Wallet, gyms can cater to diverse member preferences. Allowing members to choose scheduled billing dates and encouraging backup payment methods further strengthens payment flexibility.

Empowering members with a mobile app

Integrating a mobile app to facilitate seamless payment updates can significantly improve collection rates. Imagine your members being able to manage their payments on their terms, from the convenience of their smartphones. Plus, in-app notifications about past-due payments and other reminders ensure timely collections and enhance member experience.

Proven results with automation

Automation isn’t just a convenience; it’s a necessity. It enables a wide variety of tactics that increase your success rate without requiring human intervention. For example, timing your collection attempts to coincide with members’ pay cycles ensures you’re first in line to get paid. Having backup payment methods ready for immediate retry upon a decline further boosts your collection success.

Even small improvements in monthly collection rates can lead to significant positive impacts on your bottom line. Clubs that implement these best practices typically see a 5% increase in dollars collected within 90 days. Over 12 to 18 months, many clubs experience a 25-35% increase in total dollars collected, thanks to the compounding effect of optimized revenue cycle management.

Transforming billing challenges into opportunities

Whether you’re a fitness club owner or manager, optimizing your billing strategy is crucial for achieving better cash flow predictability and performance. An automated payment collection approach saves time and accelerates cash flows, positioning your club for sustained financial success. By choosing the best days to collect and setting up alternate billing for past-due recovery, you can significantly increase your success rates.

![ABC-Ignite]-Blog_header-monthly-product-updates_Nov_](https://ignite.abcfitness.com/wp-content/uploads/2025/11/ABC-Ignite-Blog_header-monthly-product-updates_Nov_-400x160.png)

![[ABC-Ignite]-Blog_Header_Engagement-App](https://ignite.abcfitness.com/wp-content/uploads/2025/11/ABC-Ignite-Blog_Header_Engagement-App-400x160.jpg)

![[ABC-Ignite]-Blog_Banner_2025-Payment-links](https://ignite.abcfitness.com/wp-content/uploads/2025/11/ABC-Ignite-Blog_Banner_2025-Payment-links-400x160.jpg)

![[Blog]_ABC-Ignite-October-Launches-Header](https://ignite.abcfitness.com/wp-content/uploads/2025/11/Blog_ABC-Ignite-October-Launches-Header-400x160.png)

![[ABC-Ignite]-Blog_header-monthly-product-updates_Oct](https://ignite.abcfitness.com/wp-content/uploads/2025/11/ABC-Ignite-Blog_header-monthly-product-updates_Oct-400x160.png)

![[ABC-Ignite]-Blog_Banner_2025Acquire-in-Ignite Engagement](https://ignite.abcfitness.com/wp-content/uploads/2025/11/ABC-Ignite-Blog_Banner_2025Acquire-in-Ignite-Engagement-400x160.jpg)