Prepare for the upcoming Nacha changes.

Stay ahead of the March 2026 ACH rule changes and protect your revenue. Reduce fraud, returns, and processing costs while improving the member experience with ABC Fitness’ built-in ACH validation.

What you need to know

What

Nacha is the organization that manages the rules for how money moves between bank accounts. It oversees the ACH Network, which powers Direct Deposits, bank-to-bank payments, and recurring drafts.

Why

These rules help keep payments safe and accurate. If your business takes payments directly from a customer’s bank account, sends Direct Deposit payroll, or uses recurring bank drafts, you are using ACH. That means Nacha compliance is required and helps protect both your business and your customers.

When

The new Nacha rules must be followed no later than March 20, 2026. After this date, businesses that are not compliant risk rejected payments, processing delays, and potential fees. Now is the time to prepare and ensure your ACH processes meet the updated requirements.

Nacha Compliance Made Easy with ABC Fitness' Bank Account Validation Service

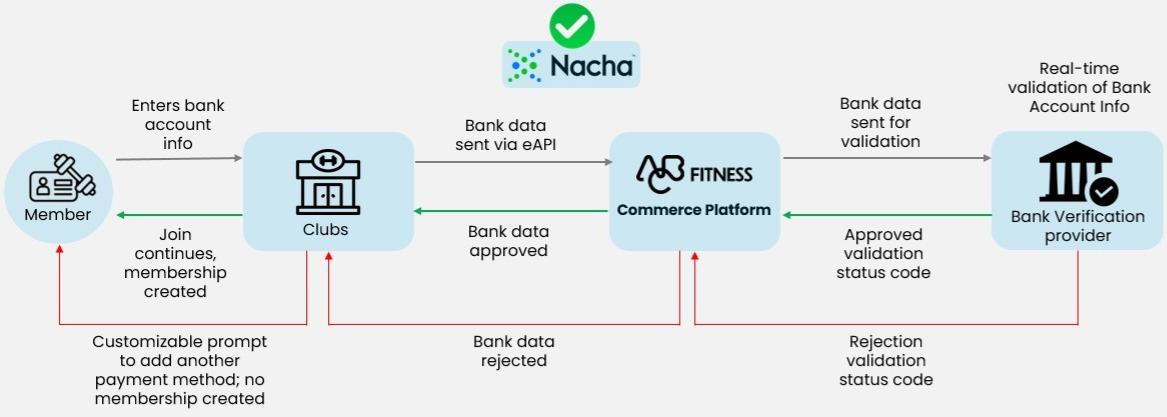

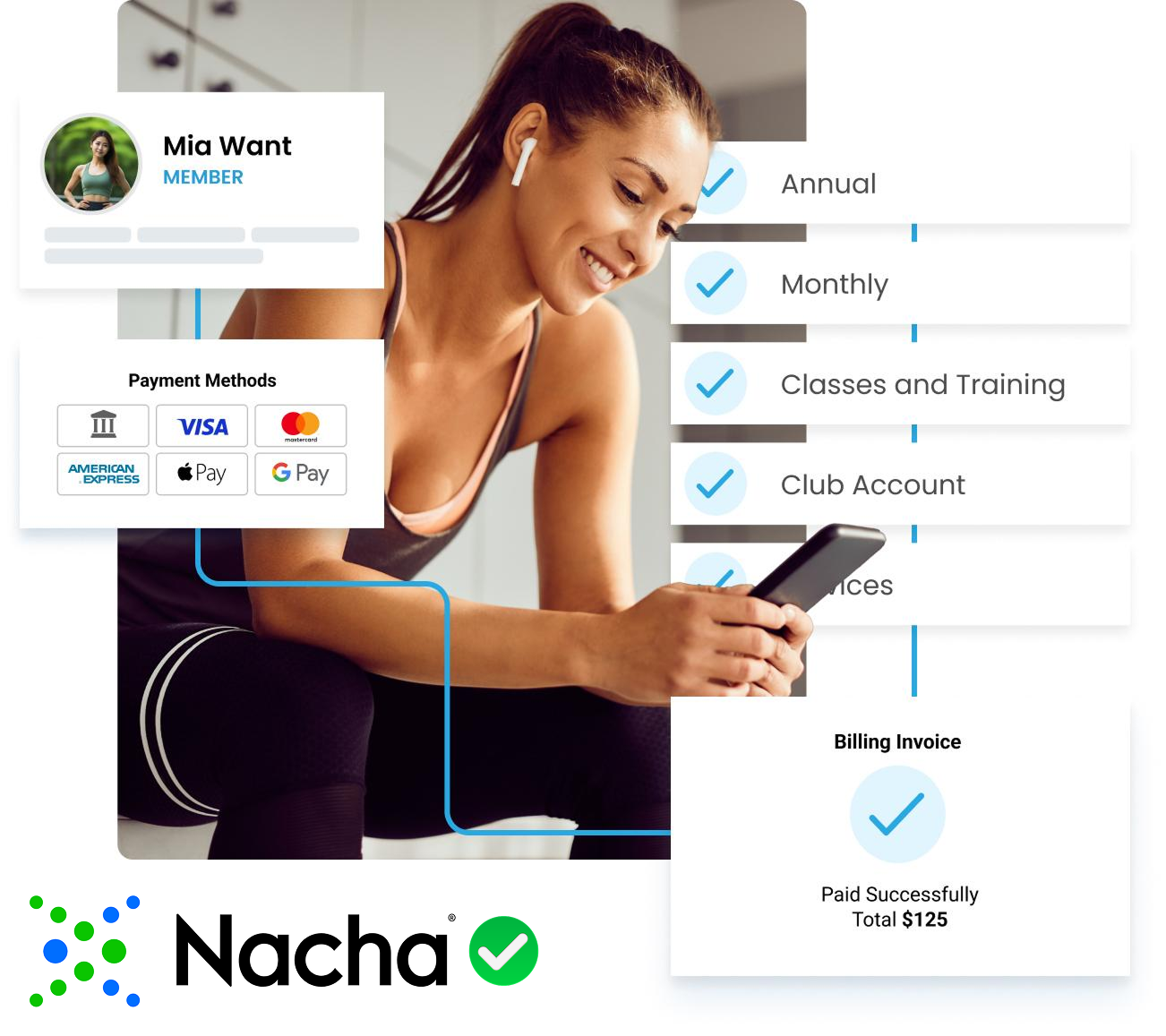

ABC Fitness is launching Bank Account Validation Service (AVS), designed to automatically support these new requirements within our platform. Our AVS tool instantly validates a member’s bank account through our verification provider. Approved accounts move forward with enrollment, while invalid accounts prompt members to choose a different payment method.

What it does:

- Verifies new and updated member bank accounts

- Helps prevent fraud and payment errors

- Reduces ACH returns and operational cleanup

What it doesn't do:

- Add friction for members

- Require manual work from your team

- Disrupt your existing payment workflows